From startups to giants in pharma and tools, the use of spatial biology is growing in importance in drug discovery.

LatchBio, a four-year-old San Francisco builder of software and data infrastructure for biopharmas, on September 5 announced its release of a 25-million-cell atlas for spatial transcriptomics covering 45 tissue types, 63 diseases, and 11 spatial technologies—the largest open-source human spatial atlas to date, according to the company.

Among pharmas, GlaxoSmithKline (GSK) applies Relation Therapeutics’ Lab-in-the-Loop platform, which integrates spatial and single-cell transcriptomics with tissue profiling, sequencing, and target validation—then combines those with multi-modal patient data, perturbational omics and translational cellular models, and machine learning. The companies aim to identify and validate targets for fibrotic diseases and osteoarthritis, with GSK agreeing to pay Relation $45 million upfront (including a $15 million equity investment), up to $63 million in collaboration payments, and an average $200 million per target tied to achieving preclinical, development, commercial, and sales milestones in the companies’ two collaborations, plus tiered royalties on net sales of products.

Speaking with GEN recently about his company’s expansion into spatial biology, Andrew Farmer, DPhil, chief scientific officer of Takara Bio USA, offered as illustrative a definition of the field as any: “It’s not just about knowing what cells are in a mixture or in a tissue, but where they are, who their neighbors are, who they’re communicating with.”

A pioneer in single-cell RNA-seq technology, Takara shook up spatial biology in January when it announced it had acquired Curio Bioscience, a spatial genomics company that was among “Up & Comers” highlighted by GEN in last year’s A-List of “Top 10 Spatial Biology Companies of 2024.”

As a result, Takara is one of this year’s Up & Comers in GEN’s updated edition of its spatial biology A-List, first published in 2021 and updated every year since.

This year’s A-List shows that the revenues for the top five public companies in spatial biology have risen nine percent from a year ago, to $3.398 billion between January 2024 and June of this year, from $3.116 billion between January 2023 and June 2024. The annual rate of increase has slumped significantly from the 21% jump shown by publicly traded companies last year compared with approximately $2.612 billion in revenues generated between January 2022 and June 2023.

Total capital raised by the top five private companies jumped eight percent year-over-year, to more than $640 million this year, from more than $591 million last year, which was a 15.5% leap from $511.5 million in 2023.

Public companies are ranked by their combined revenues for 2024 and the first half of 2025, as disclosed in regulatory filings, including sales of products or services, as well as revenue from collaborations and R&D activity. Private companies are ranked by the total capital they have raised, as disclosed by the companies themselves, either in press statements or in responses to GEN queries verifying figures compiled by other sources.

Companies that failed to respond at deadline have been ranked according to their most recently published figures for total capital raised.

Top 5 Public Companies |

1. Bruker (BSI Nano segment, including Bruker Spatial Biology)Revenue: $508.7 million in Q1-Q2 2025; $1.098 billion in 2024 At the 2025 American Association for Cancer Research (AACR) General Meeting in April, Bruker Spatial Biology launched a series of technologies that included the CosMx WTX assay for subcellular spatial imaging of the whole transcriptome, the PaintScape™ platform for visualization of 3D genome architecture and chromosomal structure in single cells, the PowerOMX™ engine for streamlined spatial proteomics analysis on the CellScape™ platform, and the 1,200-plex protein panel for GeoMx® DSP. The Bruker Scientific Instruments (BSI) Nano segment finished the second quarter with $252.1 million in revenue, down 0.2% from $252.5 million a year ago.

|

2. 10x GenomicsRevenue: $327.791 million in Q1-Q2 2025; $610.785 million in 2024 10x Genomics expanded its spatial biology footprint in August by launching Xenium Protein, an addition to its Xenium Spatial platform designed to enable simultaneous RNA and protein detection in the same cell, on the same tissue section, in a single automated run. In May, 10x eliminated eight percent of its workforce—about 100 jobs—as part of an effort to cut $50 million in costs and address uncertainty wrought by federal cuts in academic research funding. Also in May, 10x Genomics settled patent infringement lawsuits with Bruker and Vizgen. The former agreed to pay 10x $68 million plus royalties, while the latter took issue after 10x stated that it received $26 million and will receive royalties from privately held Vizgen.

|

3. Bio-Techne (Diagnostics and Spatial Biology Segment)1Revenue: $346.263 million (fiscal year ending June 30, 2025); $178.188 million (January-June 2024) Bio-Techne in April announced an Early Access Program for its latest spatial biology advancement, a new assay for in situ detection of protein proximity. Built upon Advanced Cell Diagnostics (ACD) RNAscope™ technology, the next-generation assay is designed to offer a truly integrated spatial multiomic view by revealing functional interactions between proteins within intact tissues. Also in April, Bio-Techne and Leica Biosystems expanded their spatial multiomic collaboration to include automation of ACD’s new RNAscope™ Multiomic LS Assay and protease-free workflows on Leica’s BOND RX research staining instrument. And in February, Bio-Techne launched an expanded menu of human and mouse RNAscope in situ hybridization probes, designed to advance spatial biology research and development of therapeutics and diagnostics.

|

4. Standard BioToolsREVENUE: $41.984 million in Q1–Q2 2025; $174.432 million in 2024 Eighteen months after completing a merger with SomaLogic, a leader in data-driven proteomics technology, Standard BioTools announced in June it was selling SomaLogic to Illumina for up to $425 million ($350 million of that upfront) in a deal expected to close in the first half of 2026. Standard said the deal will help it achieve a key priority of break-even adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA)—and simplify its operational and organizational infrastructure to focus more closely on its spatial, single-cell, and multiomics offerings. Those include the Hyperion™ XTi Imaging System, a mass cytometry tool for spatial proteomics highlighted in a study published February 12 in Nature.

|

5. Quanterix (including Akoya Biosciences)REVENUE: Approximately $30 million in Q1-Q2 2025;2 $81.7 million in 20243 Quanterix, a company focused on ultra-sensitive biomarker detection, completed in July its acquisition of Akoya Biosciences, a deal designed to create the first integrated solution for ultra-sensitive detection of blood-and tissue-based protein biomarkers. Quanterix issued approximately 7.8 million shares of its common stock and paid approximately $20 million in cash to Akoya’s shareholders and other equity holders. By creating a more comprehensive platform for detecting disease, Quanterix reasons, it has quintupled its total addressable market from $1 billion to $5 billion. |

Top 5 Private Companies |

1. Vizgen (includesUltivue)TOTAL CAPITAL RAISED: “More than” $250 million Vizgen celebrated the online publication on May 22 of a study in Nature Neuroscience highlighting how researchers used its MERSCOPE® high-plex single-cell spatial multiomics platform to uncover aging-related changes in white matter by single-cell and spatial transcriptomics. Also in May, Vizgen launched a strategic partnership with Hamamatsu Photonics integrating its MoxiePlex™ multiplex immunofluorescence (mIF) imaging system with Vizgen’s pathology-grade reagent and assay portfolio, creating a seamless end-to-end workflow solution designed to bring multiplexed biomarker detection into new translational and clinical research applications.

|

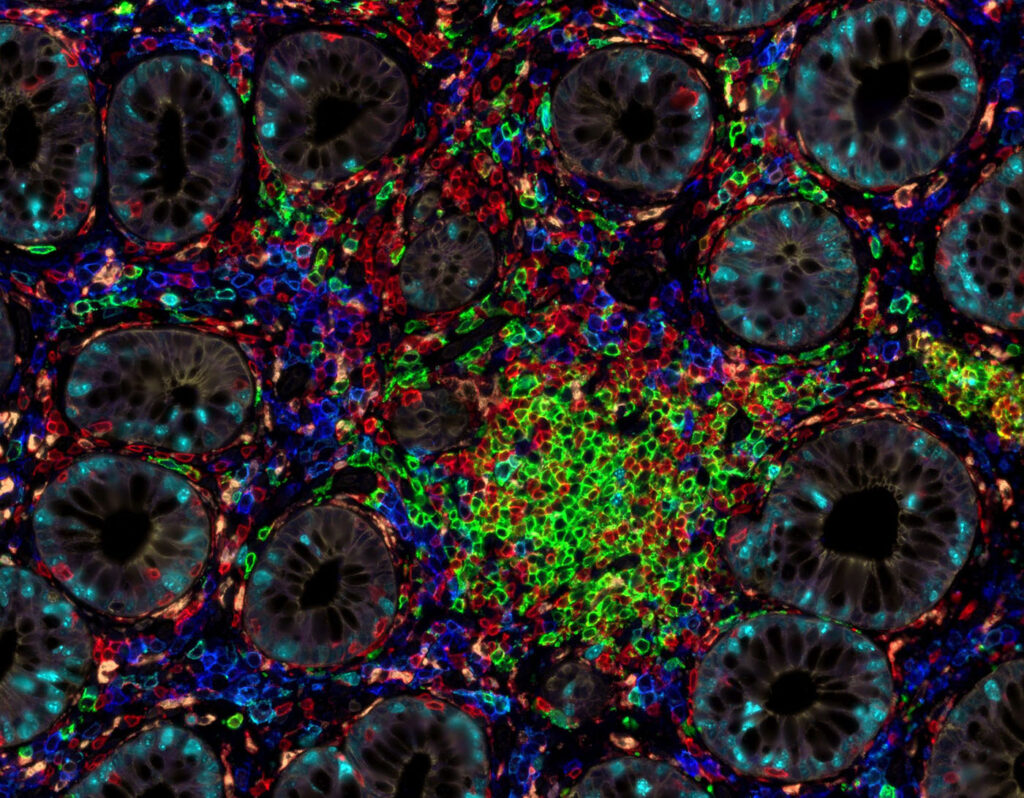

2. Resolve BiosciencesTOTAL CAPITAL RAISED: “More than” $100 million4 Joanna Bi, a life science research professional focused on genetics at Stanford University, in June posted to Protocols.io a protocol for applying Resolve Biosciences’ Molecular Cartography™ platform for full-field optical coherence tomography (FF-OCT), as used for intestinal tissue. Bi is a member of the Method Development Community of the Human BioMolecular Atlas Program, which is working to catalyze the development of a framework for mapping the human body at single-cell resolution. In recent weeks, Resolve has posted to its social media feeds job openings for a systems engineer, a lab technician focused on systems integration, and a lab technician focused on assay development.

|

3. RareCyteTOTAL CAPITAL RAISED: $125 million RareCyte, in August, received an approximately $500,000 award from the Gates Foundation to advance research into fetal growth restriction (FGR), a major cause of preterm birth, stillbirth, and neonatal morbidity worldwide. RareCyte will partner with Professor Mushi Matjila, MBChB, PhD, and Nadia Ikumi, PhD, at the University of Cape Town to conduct a two-phase study enrolling pregnant women at Groote Schuur Hospital in Cape Town, South Africa. The study is designed to generate cellular and transcriptomic profiles of circTBs from 30 women with early-onset FGR and matched healthy pregnancies, using RareCyte’s AccuCyte® Sample Preparation System and TrophoSeq™ assay platforms.

|

4. StellaromicsTOTAL CAPITAL RAISED: $105 million Stellaromics in February completed an $80 million Series B financing led by Catalyst4 with participation from Stanford University Ventures. The latest financing is intended to support the development and commercialization of Pyxa, Stellaromics’ 3D spatial biology platform. Stellaromics announced the first European deployment of its Pyxa platform in April, with the lab of Nigel Jamieson, MBBS, of the University of Glasgow applying Pyxa’s full 3D spatial multiomics workflow to investigate tumor architecture and the surrounding microenvironment. The Jamieson Spatial Lab—which operates as a spatial biology core facility—aims to uncover new cancer biomarkers that could inform pharmaceutical development and future clinical applications.

|

5. NucleaiTOTAL CAPITAL RAISED: $60 million Nucleai, an artificial intelligence (AI)-based spatial biomarker and diagnostics company, announced in April the launch of what it said was a first-of-its-kind deep learning model designed to automate the normalization of high-plex imaging data—a foundational step within the spatial proteomics workflow that is intended to accelerate the discovery of biomarkers for antibody-drug conjugates (ADCs), bispecifics, and immunotherapies. During the recent American Society of Clinical Oncology (ASCO) Annual Meeting, Nucleai demonstrated its optical density (OD)-based quantitative biomarker scoring solution, designed to solve challenges associated with manual visual scoring of immunohistochemistry (IHC) images by pathologists. |

References

- Maretty L, Gill D, Simonsen L, et al. Proteomic changes upon treatment with semaglutide in individuals with obesity. Nat Med. 2025;31(1):267-277. doi: 10.1038/s41591-024-03355-2.

- Jara M, Norlin J, Kjær MS, et al. Nat Med. Modulation of metabolic, inflammatory and fibrotic pathways by semaglutide in metabolic dysfunction-associated steatohepatitis. 2025. doi: 10.1038/s41591-025-03799-0. Online ahead of print.

To view this year’s Up & Comers click here.