Company’s osteoporosis program completes enrollment in Phase 2 trial focused on treating the disease in postmenopausal women.

US biotech Angitia Biopharmaceuticals has secured $130 million in a Series D financing to fuel the development of new medicines for musculoskeletal diseases. The money will be used to advance several clinical-stage programs, with its Phase 2 osteoporosis candidate most notable from a longevity perspective.

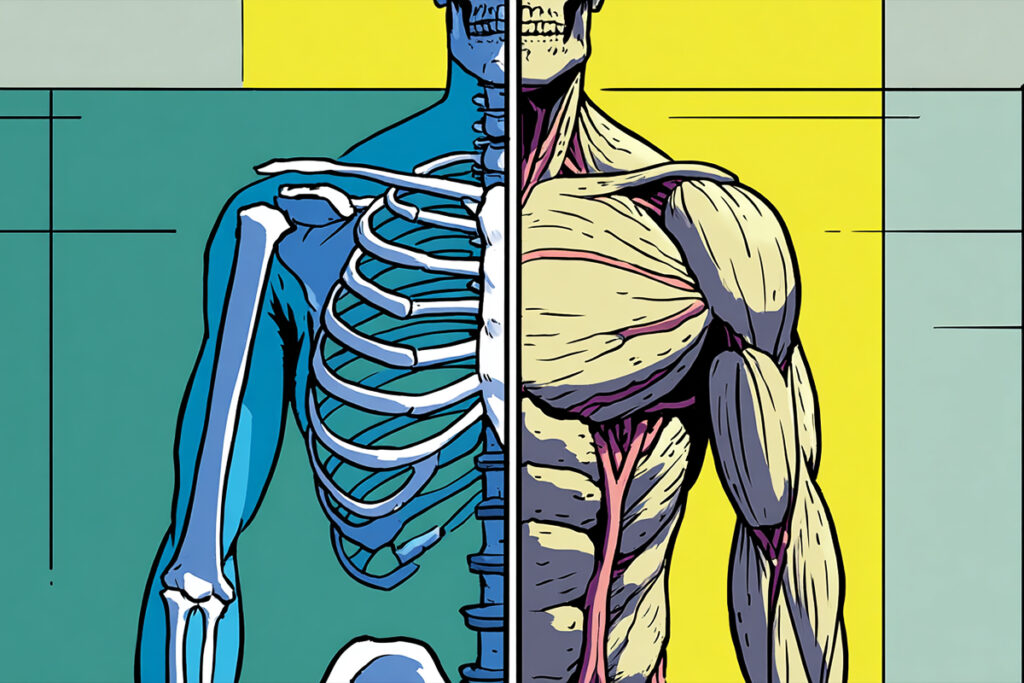

Los Angeles-based Angitia is focused on developing biologic therapies designed to strengthen bone and address conditions where it claims current treatments fall short. The company currently has three biologic candidates in clinical development, spanning osteoporosis, osteogenesis imperfecta, and spinal fusion, with several preclinical programs in other areas, including osteoarthritis.

As global populations age, osteoporosis, marked by a gradual loss of bone density and structural integrity, has become increasingly common, particularly among older women. Angitia is specifically focused on tackling postmenopausal osteoporosis, a condition that affects hundreds of millions of women worldwide. While several approved drugs exist, Angitia claims that many patients either do not respond adequately, cannot tolerate them, or are never treated in the first place.

The company’s bispecific antibody, AGA2118, simultaneously target two proteins, sclerostin and the brilliantly-named Dickkopf-1, that normally act as brakes on bone formation through the WNT signaling pathway. By blocking both at once, Angitia hopes to avoid a compensatory response that could blunt the effect of single-target therapies and, in turn, produce stronger and more durable gains in bone mineral density.

A Phase 2 trial of AGA2118 recently completed patient enrollment of 379 postmenopausal women with osteoporosis. The primary measure of success will be the percentage change in bone mineral density at the lumbar spine after 12 months of treatment, while researchers are also tracking changes in bone density at other skeletal sites and monitoring biochemical markers that reflect bone turnover. Initial topline results are expected in 2027.

The funding round was co-led by Frazier Life Sciences and Venrock Healthcare Capital Partners, alongside new backers including Ascenta Capital, BVF Partners, Logos Capital, RA Capital Management, and Wellington Management, alongside existing supporters. The company secured a $120 million Series C back in 2024.