Takeda announced last week that it would acquire at least two late-stage oncology candidates, IBI363 and IBI34, for $1.2 billion from China’s Innovent Biologics. Takeda will have worldwide commercialization rights outside of Greater China. With milestones, the deal offers an additional up-to-$10.2 billion for Innovent, making it possibly one of the largest biotech partnerships of the year.

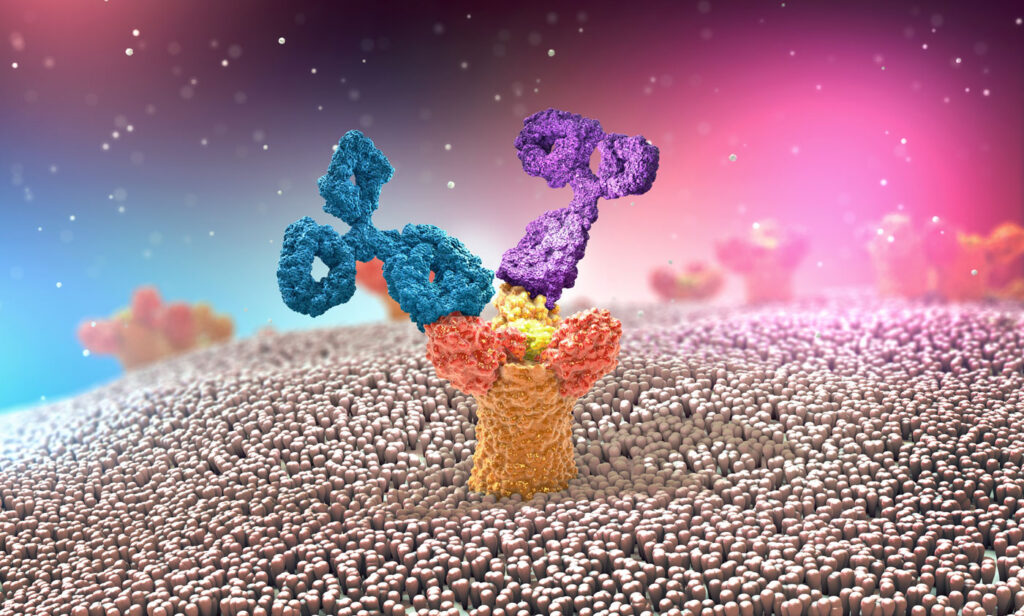

Both drug candidates are antibody-drug conjugates (ADCs) that target hard-to-treat cancers. IBI363 is a potential first-in-class PD-1/IL-2α-bias bispecific antibody fusion protein being evaluated in non-small cell lung and colorectal cancers. IBI343 is a “next-generation” investigational ADC that targets the Claudin 18.2 protein, which is often expressed in gastric and pancreatic cancer cells. Takeda will also receive an exclusive option to license global rights outside of Greater China for IBI3001, an early-stage investigational compound.

“IBI363 and IBI343, two next-generation investigational medicines, have the potential to address critical treatment gaps for patients with a range of solid tumors,” said Teresa Bitetti, president, Global Oncology Business Unit, Takeda. “These two programs have the potential to be transformative for our oncology portfolio and significantly enhance Takeda’s growth potential post-2030.”

In early studies, more than 1,200 patients received IBI363, including patients who were refractory to PD-1/L1 therapy. The compound has shown promising clinical activity in several solid tumor types, including squamous non-small cell lung cancer (NSCLC), non-squamous NSCLC, and microsatellite stable colorectal cancer.

The U.S. FDA has granted Fast Track designation to IBI363 for the treatment of patients with unresectable, locally advanced or metastatic squamous NSCLC that has progressed following anti-PD-(L)1 therapy and platinum-based chemotherapy.

The compound is being studied globally in an ongoing Phase I/II and three ongoing Phase II clinical trials in NSCLC and MSS colorectal cancer. A global Phase III study in second-line squamous NSCLC is expected to begin in the coming months. Clinical development of IBI363 in additional indications is planned. Takeda and Innovent will co-develop IBI363 globally.

IBI343 is a “next-generation” investigational ADC that targets the Claudin 18.2 protein, which is often expressed in gastric and pancreatic cancer cells. The compound has shown promising clinical activity in studies in gastric cancer and advanced pancreatic cancer, with more than 340 patients having been treated with it. These cancers have among the lowest five-year survival rates.

The FDA has granted Fast Track designation to IBI343 for the treatment of advanced unresectable or metastatic pancreatic ductal adenocarcinoma that has relapsed and/or is refractory to one prior line of therapy. IBI343 is currently being evaluated in an ongoing Phase III clinical trial in previously treated gastric cancer in Japan and China and has completed a global Phase I/II trial in previously treated pancreatic cancer.

Takeda plans to advance the development of IBI343 and expand into the first-line gastric and pancreatic cancer settings. Under the terms of this agreement, Takeda will develop, manufacture, and commercialize IBI343 worldwide, outside of Greater China.

Andy Plump, president, Research and Development, Takeda, said “We are encouraged by the clinical results these investigational medicines have shown and look forward to working with Innovent to deliver these potentially best-in-class medicines to patients with longstanding unmet needs across a wide range of cancers.”

IBI3001 is another potential first-in-class bispecific ADC designed to target both EGFR and B7H3. It is being studied in an ongoing Phase I clinical trial in patients with locally advanced or metastatic solid tumors in the U.S., China and Australia. As part of the agreement, Innovent will be solely responsible for clinical development of IBI3001 prior to potential exercise of the option to license. Should Takeda exercise the option, it will develop, manufacture and commercialize IBI3001 worldwide, outside of Greater China.

Innovent will receive a $1.2 billion upfront payment upon closing of the transaction, which includes an equity investment of $100 million in Innovent by Takeda. The upfront payment will be funded through cash on hand. Innovent will also be eligible for potential milestones and royalty payments, and a profit or loss split 60/40 (Takeda/Innovent) solely with respect to IBI363 in the U.S., where Takeda will lead the commercialization effort while Innovent will have a co-commercialization right.

If Takeda exercises the option for IBI3001, Innovent will be eligible for an option exercise fee and additional potential milestone and royalty payments making the overall deal worth potentially more than $11 billion.