Marc Hedrick, MD, MBA, a physician-turned-biotech executive, has been tracking survival curves for cancer for decades. While survival rates for many cancers have improved, sometimes dramatically, Hedrick noticed patients with central nervous system (CNS) cancers have been left behind. “Over the last forty years, survival rates for cancers outside the CNS have increased by 300%,” Hedrick told Inside Precision Medicine. “For CNS cancers, the survival curve is basically flat. Despite all the advances in imaging, despite MRI transforming how we diagnose and locate tumors, the outcomes have hardly changed.”

For Hedrick, President and CEO of Plus Therapeutics, the lesson is clear: incrementalism won’t cut it. “Taking the same old small molecule approach to trying to prove survival has not worked for 40 years,” he said. “It’s time to throw out the playbook and start over.” That conviction has led Plus Therapeutics down an unconventional path—one that fuses therapeutics, diagnostics, and data into a unified strategy aimed at doing what no one else has managed: bending the CNS cancer survival curve. The company’s latest milestone, a national coverage agreement with UnitedHealthcare for its CNSide cerebrospinal fluid (CSF) assay, is as much about that mission as it is about market access.

Bending a stubborn curve

Hedrick frames the challenge with a striking historical parallel. Around the early 1980s, MRI technology revolutionized oncology, enabling physicians to see tumors in unprecedented detail. For cancers of the breast, lung, colon, and many others, that leap in imaging helped unlock a cascade of therapeutic advances. “For CNS cancers,” Hedrick said, “MRI gave us diagnostic clarity without therapeutic progress. Doctors rely heavily on MRI to figure out the diagnosis, the location, and what to do next. But the outcomes? They didn’t move.”

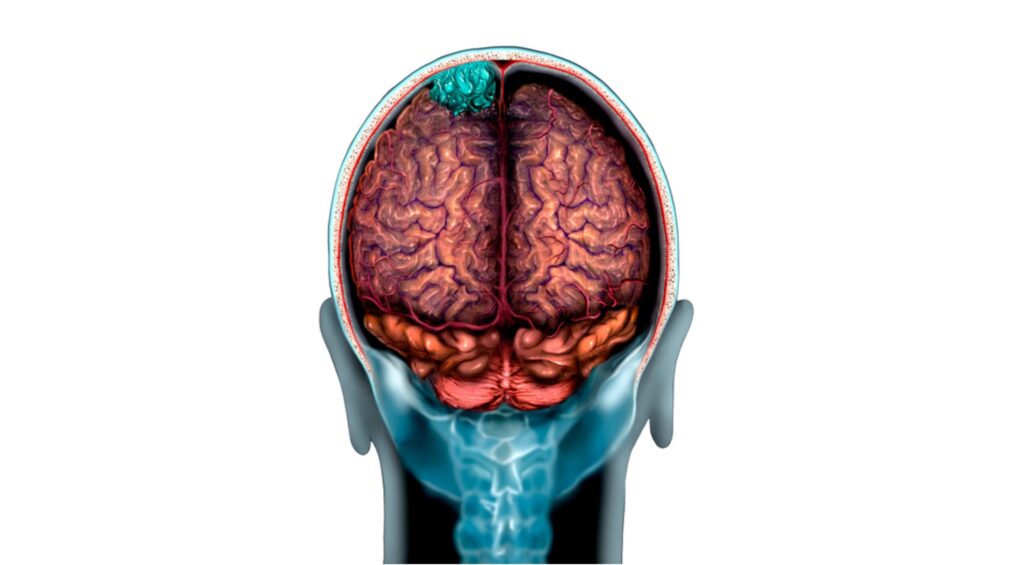

Part of the reason is biology. The brain is encased in the blood-brain barrier, a defense that protects it from toxins and infection—but also keeps out 98% of potential drugs. Surgical options are limited, and radiation is often too diffuse for cancers that infiltrate delicate neural tissues. The result, Hedrick argues, is a therapeutic stalemate. “Forty years of therapeutic inadequacy should tell us something. We can’t keep applying the same strategies and expect different results.”

Plus Therapeutics began life as a therapeutics company, acquiring and licensing five programs aimed squarely at CNS cancers. Early clinical trials, however, revealed a nagging obstacle: how do you measure whether a drug is working inside the brain? “With tumors in the breast or lung, you can biopsy or rely on blood-based liquid biopsies,” Hedrick explained. “With CNS cancers, that’s extremely difficult.”

The breakthrough came when Plus researchers began exploring the fluid that bathes the brain and spinal cord—cerebrospinal fluid. “We realized liquid-based technology could tell us if we were making an impact on the tumor,” Hedrick recalls. “That’s the technology we ultimately acquired.” That platform, now branded CNSide, had already been commercialized once before, with 11,000 tests performed. But Plus saw room to refine and relaunch it in a way that maximized clinical and precision medicine value.

At its core, CNSide is designed to interrogate the biology of CNS cancers by analyzing cerebrospinal fluid, obtained either via lumbar puncture or through an Ommaya reservoir—an implanted port that provides long-term access. “It’s a one-stop shop,” Hedrick said. “It helps us make the diagnosis. It allows a quantitative measure or biomarker for tumor burden. It tells us what drugs may work or may not work. It has cellular, intracellular, and genomic profiling capability.”

Unlike blood, which rarely contains tumor cells from the brain, CSF reflects the disease process directly. CNSide can detect a single tumor cell in eight cubic centimeters of fluid with high sensitivity and specificity. Once isolated, those cells can be profiled for gene expression, cell-surface markers, and treatment susceptibilities. Hedrick estimates as many as one million U.S. patients may be candidates for this kind of testing. “That’s a sizable population,” he emphasizes, “and one that has been underserved for far too long.”

Three-legged stool

The company’s immediate focus is on leptomeningeal metastases (LM), a devastating condition in which cancer cells from primary tumors like breast, lung, or melanoma infiltrate the thin membranes surrounding the brain and spinal cord and shed into the CSF. “Doctors who are neuro-oncologists tell me, ‘Mark, we have an epidemic in leptomeningeal cancer,’” Hedrick said. “We can control breast cancer and lung cancer better than ever, but cells pop up in the brain and spinal cord. Once that happens, the prognosis is very bad. Without treatment, survival is four to six weeks; with a kitchen sink approach, maybe four to six months. There’s nothing approved for it.”

Despite its severity, LM remains underdiagnosed, in part because the gold standard test—CSF cytology—dates back to 1904. “It’s over a hundred years old,” Hedrick points out. “You spin down the fluid, stain it, and look under a microscope. The sensitivity is sub-50%. A negative result doesn’t mean you don’t have LM. It just means the test didn’t pick it up.” By contrast, CNSide applies a cocktail of antibodies that enrich for cancer cells while letting noncancerous cells pass. The captured cells can then be analyzed in depth. “We can not only detect the presence of disease but also characterize its biology,” Hedrick said. That’s critical because LM tumors often diverge biologically from their parent tumors. “Take HER2-positive breast cancer,” Hedrick offers. “In the brain, HER2 expression can flip—upregulated or downregulated compared to the primary tumor. That can send you down a completely different therapeutic pathway. A drug that worked in the breast may not work in the brain.”

For Hedrick, LM exemplifies why CNSide is more than a diagnostic—it’s a personalization engine. “This disease is really a poster child for personalized medicine,” he said. The CNSide relaunch marks a broader evolution for Plus Therapeutics, which now sees itself not just as a therapeutics developer, but as a platform company straddling diagnostics, therapy, and data analytics. “The therapeutics help drive the diagnostics, and the diagnostics reinforce the therapeutics,” Hedrick explained. “Together, they generate the analytical horsepower we need. It’s a cycle, each part reinforcing the other.” This integrated model, he argues, is unique. “Even big companies don’t do it. Therapeutic companies don’t usually own diagnostics. Diagnostics companies don’t develop therapeutics. And data analytics tends to live in a different ecosystem altogether. But if you want to truly change outcomes for CNS cancer patients, you need all three legs of the stool.”

At the nearest clinic near you

Against this backdrop, the announcement that UnitedHealthcare—the largest private insurer in the U.S.—will provide national coverage for CNSide represents both validation and acceleration. “UnitedHealth has about 51 million covered lives,” Hedrick notes. “It’s a great start as we build a payer network to support the test.”

Coverage decisions matter not just because they open the door to reimbursement, but because they signal payer recognition of a test’s value. “If you’re a payer, you want to provide care that impacts common cancers like breast and lung,” Hedrick said. “Leptomeningeal metastases affect those patient populations directly. This is one area where you can make a quick impact.” CNSide’s quantitative capabilities also add prognostic value. “The more tumor cells in the brain fluid, the worse the prognosis,” Hedrick explained. “If you can measure those cells over time, you can determine whether the tumor is expanding or shrinking. That correlates directly with survival.”

While UnitedHealthcare is the first major insurer to step forward, Plus is in discussions with others, including Medicare. “The plan is to have all major payers on board,” Hedrick said. For Hedrick, the UnitedHealthcare decision is a step forward—but also a reminder of the mission still ahead. “There just aren’t companies out there that have really done this,” he said. “We’re unusual in being focused on one anatomic area of the body and being tech-agnostic across diagnostics, therapeutics, and drug delivery. But that’s what makes sense. It’s the only way we can really make a material impact for these patients.”

As CNSide expands into clinics and payers begin to recognize its value, Hedrick sees momentum building toward a future where CNS cancers are no longer an intractable outlier in oncology. “This is just the beginning,” he said. “If we want to bend the survival curve, we have to throw out the playbook. And that’s exactly what we’re doing.” Clinics and payers aren’t the only ones to recognize the value of CNSide, as Plus Therapeutics stock jumped up over 40% following the announcement to partner with UnitedHealthcare.

Ultimately, Hedrick’s vision is not just to detect CNS cancers earlier but to transform how they are managed. “Our view is we can turn leptomeningeal cancer into a chronic disease,” he said. “But you have to be able to personalize the approach, and diagnostics are critical to that.” By building a feedback loop between diagnostics, therapy, and data, Plus hopes to create a new paradigm where CNS cancers can be controlled, monitored, and adjusted for dynamically, much like other chronic conditions. “It’s been an evolution,” Hedrick reflects. “Two years ago, we recognized the limitations of 40 years of therapeutic inadequacy. That’s when we made the fundamental shift in our paradigm. It’s not just about one drug or one test. It’s about building a platform that gives us a meaningful shot at improving outcomes.”